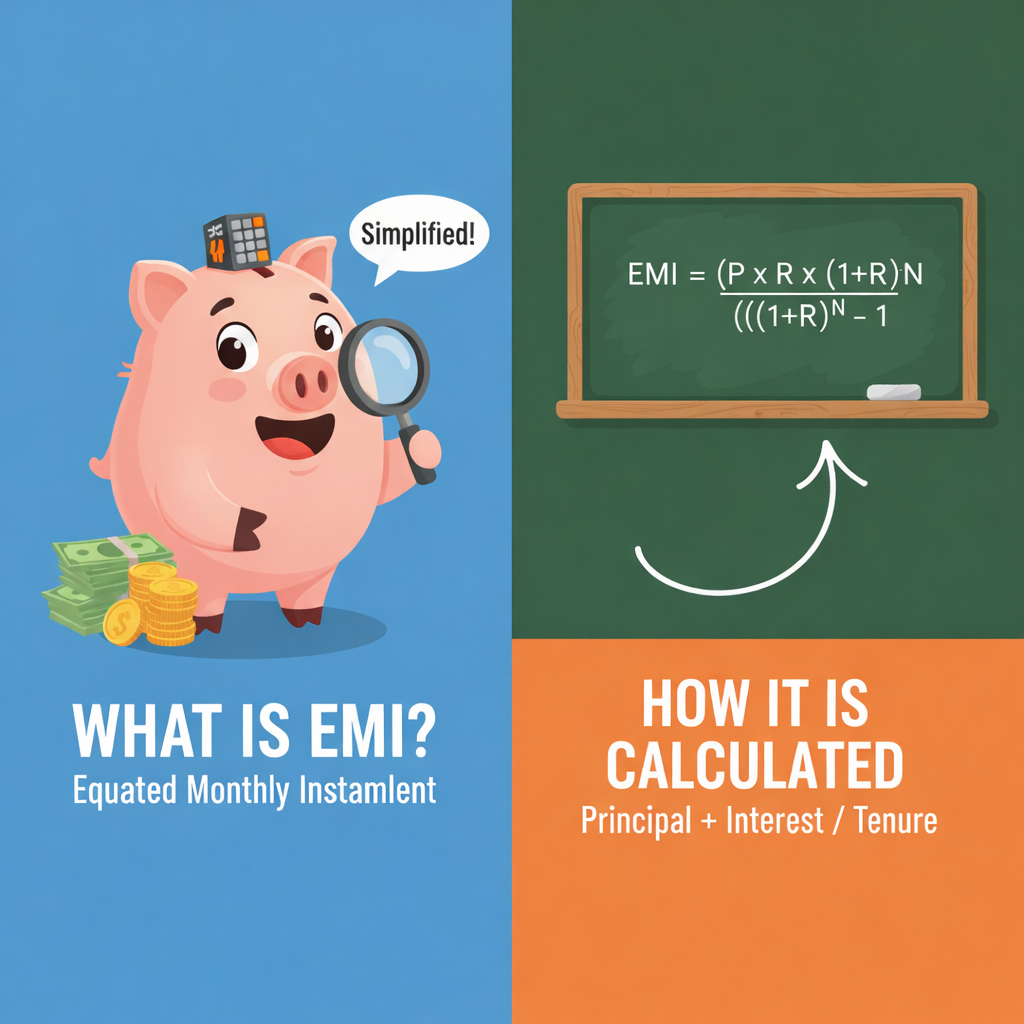

Why EMIs Feel Small but Cost You Big Over Time?

Many people don’t realize why EMIs feel small but cost you big over time, especially when interest compounds over long repayment periods. At first glance, EMIs (Equated Monthly Installments) feel harmless. A small monthly payment doesn’t look dangerous. In fact, it often feels manageable—even convenient. A new phone, a car, furniture, or even a house […]